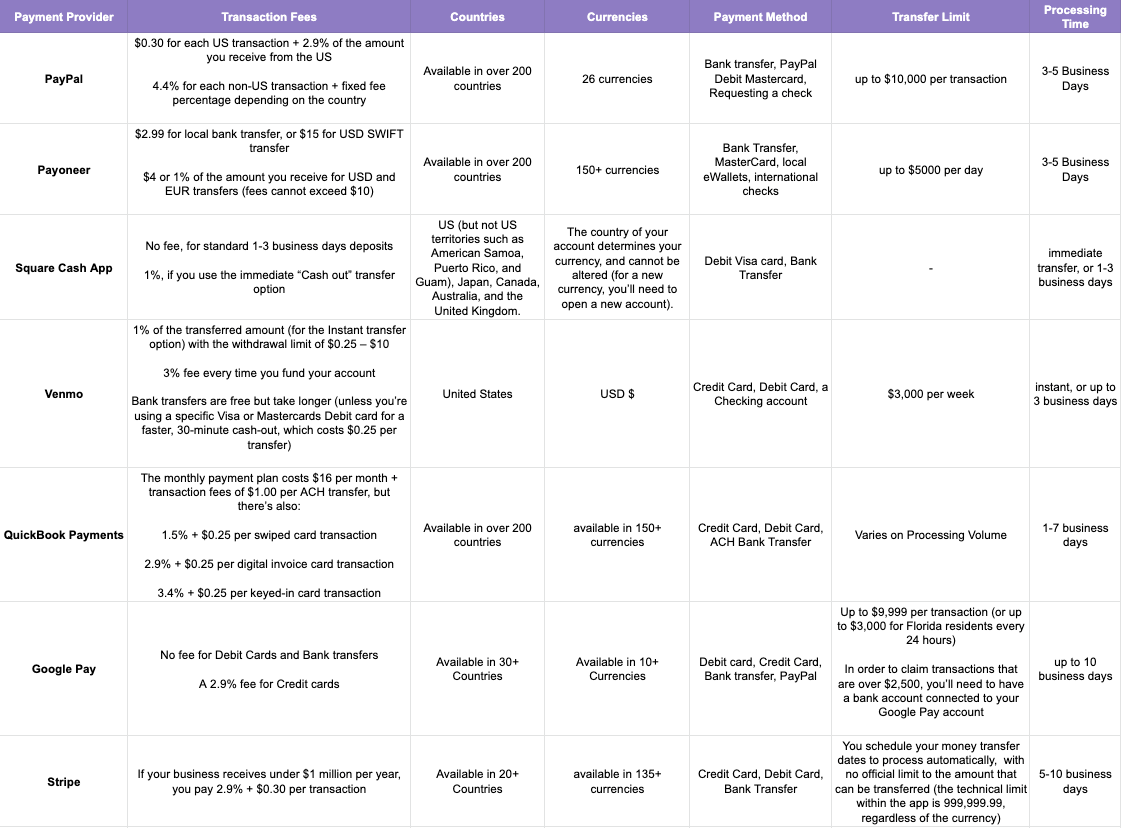

As Freelancers, getting paid is important. And limiting the amount of payment processor fees is even more important. Losing 3% of every payment can significantly add up over time, so we’ve outlined all the different payment processors and highlight some additional ways to get paid without any fees!

Bank or Wire Transfer

Bank or Wire Transfer will still be your best option for getting paid from your clients. These don’t have any additional fees associated and are incredibly quick in the processing times. It’s certainly faster than waiting for a check in the mail.

Zelle

Zelle is available through most US banks and allows for easy wire transfer between bank accounts both inside and outside your banking platform.

If you’re not able to receive funds through a bank transfer, below you’ll find information on different payment processors and relevant information associated with them.

Paypal

- Transaction Fees: $0.49 for each US transaction + 2.9% of the amount you receive from the US; 4.49% for each non-US transaction + fixed fee percentage depending on the country

- Countries: Available in over 200 countries

- Currencies: 26 currencies

- Payment Options: Bank transfer, PayPal Debit Mastercard, Requesting a check

- Transfer Limit: up to $60,000 per transaction

- Processing Time: 3-5 Business Day

Payoneer

- Transaction Fees: 3% for credit card transactions (all currencies). 1% for ACH bank debit transactions. 0% to receive payments from other Payoneer users’ account balances. $1.50 to transfer funds from Payoneer to your bank account; up to 2% to transfer from a nonlocal currency.

- Countries: Available in over 200 countries

- Currencies: 150+ currencies

- Payment Options: Bank Transfer, MasterCard, local eWallets, international checks

- Transfer Limit: up to $5000 per day

- Transfer Time: 3-5 Business Days

Square Cash App

- Transaction Fees: No fee for standard 1-3 business days deposits. If you use the immediate “Cash out” transfer option, there’s a 0.5% -1.75% fee (with a minimum fee of $0.25), and it arrives instantly to your debit card.

- Countries: US (but not US territories such as American Samoa, Puerto Rico, and Guam), Japan, Canada, Australia, and the United Kingdom.

- Currencies: The country of your account determines your currency, and cannot be altered (for a new currency, you’ll need to open a new account).

- Payment Options: Debit Visa card, Bank Transfer

- Transfer Time: Immediate transfer, or 1-3 business days

Venmo

- Transaction Fees: 1.75% per transaction ($0.25 minimum and $25 maximum). Bank transfers are free but take longer (unless you’re using a specific Visa or Mastercards Debit card for a faster, 30-minute cash-out, which costs $0.25 per transfer)

- Countries: United States

- Currencies: USD $

- Payment Options: Credit Card, Debit Card, a Checking account

- Transfer Limit: If you’ve confirmed your identity, you can transfer up to $19,999.99 to your bank per week. However, there’s a $999.99 limit for those who haven’t confirmed their identity.

- Transfer Time: instant, or up to 3 business days

QuickBook Payments

- Transaction Fees: The monthly payment plan costs $15 per month for your first 3 months and $30 per month after that + transaction fees of 1% per ACH transfer, 2.5% per swiped card transaction, 2.99% per digital invoice card transaction, and 3.5% per keyed-in card transaction

- Countries: Available in over 200 countries

- Currencies: Available in 150+ currencies

- Payment Options: Credit Card, Debit Card, ACH Bank Transfer

- Transfer Limit: Varies on Processing Type

- Transfer Time: 1-7 business days

Google Wallet (Formerly Google Pay)

- Transaction Fees: No fee for Debit Cards and Bank transfers. A 2.9% fee for Credit cards

- Countries: Available in 30+ Countries

- Currencies: Available in 10+ Currencies

- Payment Options: Debit card, Credit Card, Bank transfer, PayPal

- Transfer Limit: Up to $9,999 per transaction (or up to $3,000 for Florida residents every 24 hours). In order to claim transactions that are over $2,500, you’ll need to have a bank account connected to your Google Wallet account

- Transfer Time: Up to 10 business days

Stripe

- Transaction Fees: If your business receives under $1 million per year, you pay 2.9% + $0.30 per transaction

- Countries: Available in 20+ Countries

- Currencies: Available in 135+ Currencies

- Payment Options: Debit card, Credit Card, Bank transfer

- Transfer Limit: You schedule your money transfer dates to process automatically, with no official limit to the amount that can be transferred (the technical limit within the app is 999,999.99, regardless of the currency)

- Transfer Time: 5-10 business days

Now that you have an understanding of all the different payment processors check out our article on How to Get Paid Faster as a Freelancer.