Becoming a freelancer is exciting! After all, you probably won’t hate your boss when it is you. When you work for yourself, have a lot more freedom. But with that freedom can sometimes come unpredictability.

That's why having a solid budget as a freelancer is so critical. Keep reading to learn exactly how to budget your money as a freelancer. Budgeting will ensure you don’t have to worry constantly about if you can pay your bills on time. And trust me, that’s a good feeling!

Project your Earnings

One of the first things you need to do as a freelancer is to project what you're going to earn in a particular year. This is challenging to do when you're first getting started, but it gets easier with time.

The reason you should look at things a year out is that freelance work involves lots of ups and downs. Some months you'll be killing it, wondering what to do with all your extra cash. Other months you're worried the utility company is going to shut the lights off.

But if you plan for the inconsistency it will help smooth the ride. The best way to project your earnings is to plan based on your consistent work. If you have a few clients that you work with long term you probably have a good idea how much you’ll make from them each month.

Although you'll likely have a fair number of one-off projects, budgeting for these projects can be risky. If they don't come through or pay less than expected, you might end up strapped for cash.

That’s why I always recommend giving yourself a buffer, even for consistent work. Let’s say you expect to earn $5000 in June, but only $2000 in January during your slow season. Instead of banking on $3500/month, adding in a buffer and budgeting based on $3000 will ensure you can meet your targets.

Decide How Much to Pay Yourself

Once you get paid as a freelancer, it can be tempting to spend everything you take in. Being a disciplined freelancer is tough, but it will make your life and business more successful in the long run.

Paying yourself is just one component of making your budget as a freelancer. Also, remember to set aside some of your income to continue growing your business. This will make your freelance work more sustainable.

There are a few ways to decide how much to pay yourself. You could give yourself a set salary. Let's say you pay yourself $3000 a month. If you make extra money for one month, it goes into your business account. This extra money could make up your income for a less profitable month. You may also need it to pay for ongoing business expenses or professional development.

Another option is to pay yourself a percent of the profits. This means your income from month to month will vary a lot more. If you choose to go this route (or even if you don’t), it is important to have an emergency fund. I’ll get into that in a later section, so be sure to keep your eyes peeled.

Carefully Document Earnings and Spending

To be a successful freelancer, you need to know your clients. This is true not only for producing quality content but also for your own sanity. Maybe you have that one client who always pays late. Or you can expect payment from another on Tuesday each week.

Keeping track of this information will help you budget. That's because you'll know when money will come in. Having a proper system for money management is also critical. Using a business bank account, tracking expenses and payments, and saving all your receipts are a must.

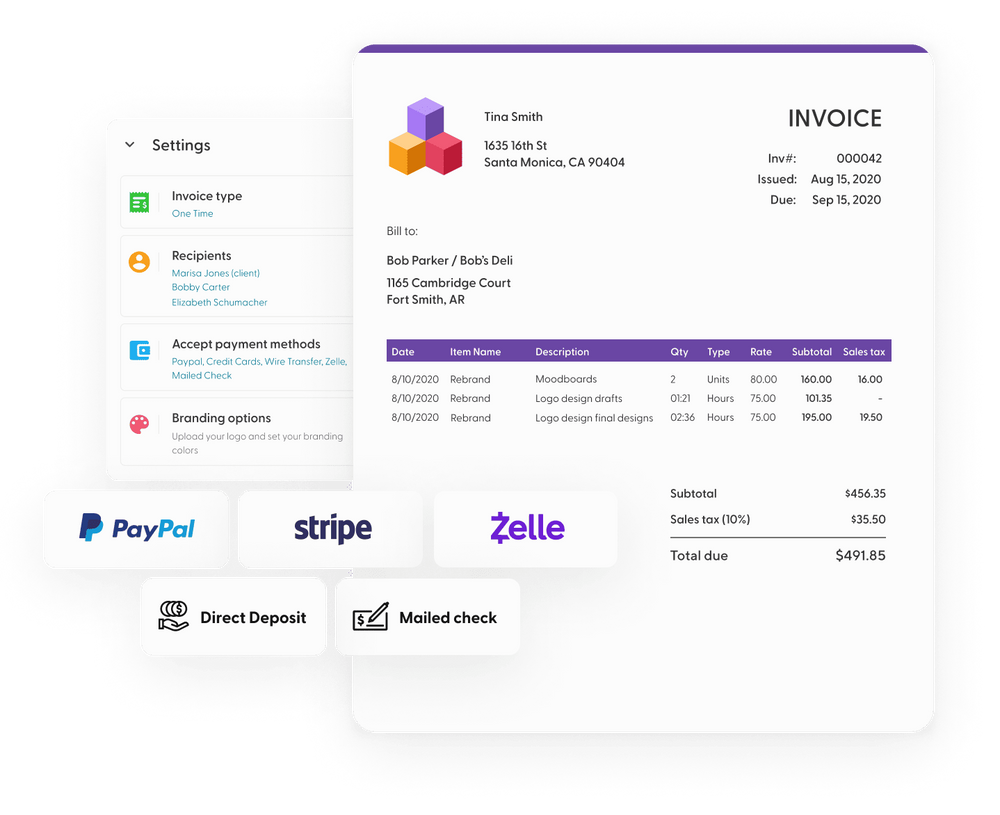

It is also important to remember that you are a business. Not only should you treat yourself like a business by carefully tracking everything, but your clients should treat you like one too. If you have a client who hasn’t paid you on time, don’t be afraid to contact them and ask for payment. And if you need help with your invoicing system, Indy has a tool that does just that.

It is also important to remember that you are a business.

Careful documentation will help ensure you stay on budget. This brings me to my next point.

Budget for Necessities

Since income can vary so much as a freelancer, it is important to keep your expenses as consistent as possible. There are some things you absolutely need to budget for as a freelancer. Food, housing, utilities, transportation, and healthcare expenses are non-negotiable.

Using the 50/30/20 budget can be a great tool for a freelancer. This budget means you dedicate 50% of your income to needs, 30% to discretionary spending, and the final 20% to savings. If you have projected your income with a buffer, you will know if your income is enough. Ideally, your income will be enough to cover your expenses for all three buckets.

If your current income doesn’t meet your needs, don’t panic. Instead, this is a clear sign it is time to hustle. One of the best ways to make it as a freelancer is to find more work. So, take advantage of your network connections and hopefully, you'll score some sweet new contracts.

Contribute to Your Emergency Fund

When you’re a freelancer, your budget should stay the same, but your income could vary. The worst part is, there isn’t always a way to predict the drops. There is always potential for losing a client or not getting as much work as expected.

Everyone should have an emergency fund for unexpected expenses, like a heater going out or unplanned medical bills. This fund is especially important for freelancers, though. Not only could you have unexpected expenses, but there could be lulls in work as well.

Everyone should have an emergency fund for unexpected expenses.

That is why every freelancer should build up their emergency fund. If you are just getting started as a freelancer, don’t wait. Instead of delegating so much of your income to discretionary spending, put it towards building your emergency fund. I recommend building this fund to cover a minimum of 3-6 months of expenses.

Not only will having an emergency fund potentially save you, but it will also decrease the day-to-day stress. We have a lot on our plates as freelancers. An emergency fund takes one worry out of the picture. If the worst happens, you’ll be prepared for it. This will allow you to continue to grow your business without fear.

Don’t Forget to Set Aside Money for Taxes

Making money as a freelancer is such an amazing feeling. Especially when you’re just getting started! But there is an important difference between freelancing and traditional salary-based jobs. With a salary-based job, your employer withholds taxes and will send you a W2 tax form at the end of the year. No one takes taxes out of your paycheck as a freelancer.

That doesn't mean you don't have to pay taxes, though. (How I wish that were the case!) Rather, you pay your own taxes. This means your budget as a freelancer needs to include taxes. In general, plan to set aside 25-30% of each paycheck for taxes immediately.

Put this money in a separate savings account and don’t touch it! After all, it doesn’t really belong to you. Then when quarterly tax time comes around, you will already have the money set aside for payments. Freelancers need to file taxes annually like everyone else, but you also need to make quarterly payments as you earn your money.

If you feel overwhelmed with having to manage your taxes, I highly recommend consulting with an experienced tax professional. They can help you calculate how much to pay for taxes each quarter. That way you don’t get hit with a big penalty come April 15th. A good tax professional may cost money, but they will probably save you even more!

Time to Become a Profitable Freelancer

Making a budget as a freelancer doesn’t have to be a nightmare. In fact, once you get it down, your business will thrive. Whether you’ve been freelancing for a while or you're just getting started, it’s time to put a budget in place. Your future self will thank you!