It can be really challenging as a freelancer to understand how to set your rates. It doesn’t matter if you’ve been freelancing for years or are just getting started, everyone is often wondering if their rates are the best that they can be.

Many freelancers only think about the salary they want to achieve and don’t necessarily think about the additional business expenses that come with being a freelancer. Companies, where you’re a W2 employee, have a lot of expenses outside of just your salary that they pay for you - healthcare, retirement benefits, equipment, and employment taxes all add up.

When you’re beginning to set your fees, understanding all of these business expenses will help ensure that your business expenses aren’t dipping into your salary too much.

What "overhead expenses" do freelancers have?

Freelancers deal with a list of additional business expenses that traditional employees don't have to worry about. Things that might have never crossed your mind until you dipped your feet into the world of freelancing. Here are some important things to factor into your freelance rate to have a profitable freelance business:

Health insurance

This is the big one. Health insurance is a great perk that comes with traditional employment. But as a freelancer, you have to find your own insurance plans. Fortunately, there are quite a few options like the Affordable Care Act, COBRA coverage, and the Freelancers Union. You might even be able to get health insurance through your spouse's employment plan. Read more about how to find health insurance as a freelancer.

Self-employment taxes

Along with health insurance, various taxes will also eat into your hourly rate. In addition to the standard federal and state income taxes, freelancers have to pay a self-employment tax rate of 15.3% as of 2022. Why? This takes care of the Social Security and Medicare taxes that company's usually cover for their employees. This additional tax comes as quite a shock to first-time freelancers, but you can take the sting out of the self-employment tax by accounting for it in your freelance hourly rate (which we'll talk about more below!).

Accountant fees

A freelancer's income can get complicated fast. And although it might be tempting to save some money by doing your own taxes, this is one area that you shouldn't hold back on.

But don't hire just any accountant. With all the various taxes and expenses, you'll want to partner with a great accountant who's worked with freelancers before.

The benefit of working with an accountant who has a strong knowledge of the ins and outs of freelancing can't be understated. They'll help you find areas you never knew could be counted as business expenses, saving you from some pretty hefty taxes. The amount of money an accountant can save you will pay for the fees themselves.

Software costs

Every freelancer has monthly software costs for running their business. Many industries require you to invest in specific software to perform your job, such as editing software, design software, coding software, and writing software. But beyond this, freelancers also have monthly fees for things like website building and web hosting services, accounting software, and tools to help manage your business.

Paid vacation and sick days

Freelancers will also need to factor in their own vacation and sick days. Unlike employment, there isn't anyone to plan these details for you. One huge benefit of freelancing is that you can work while traveling. In fact, many freelancers travel the world while still getting work done for clients. Although not everyone will enjoy working while on vacation and will need to plan the logistics of when to take time off and for how long.

Retirement savings

It can be challenging to think about retirement when you're just trying to cover all the expenses you're facing right now. However, planning for your retirement is another important thing you need to think about when freelancing. Many companies provide their employees with 401(k) plans and other benefits, but freelancers need to find their own plans.

As with healthcare, there are multiple options for freelancers who want to maximize their retirement savings, including a SEP IRA and Solo 401(k). Learn more about retirement options for freelancers.

Phew! These are the main expenses to think about when calculating your hourly rate. But before we walk through Indy's freelance hourly rate calculator, here are a few questions you need to ask yourself.

Before calculating: Ask yourself some basic questions

Now that we've covered all the expenses that come with freelancing, you should start by asking yourself some common questions that'll help determine what your minimum hourly rate should be.

Are my skills in demand?

Who is your target customer? Research these potential clients and check to see how in-demand your skills are. This will help you determine a rough market value for your skill set. The more in demand your skills, the higher the rate you can charge. If you discover that your skills aren't very in demand, you can always upskill with some additional training. Pick a skill within your niche that has room to grow and become an expert in that service.

What are my competitors charging?

Looking around to see what other freelancers are charging in your industry and at your experience level can be really helpful when first getting started. Putting a price on your skills can be tricky, and this helps you to see the current market rates for your skills. Sometimes, clients will have a figure in mind for what they've paid previous freelancers. If your rates are a lot higher than those current market rates, you'll need to prove to the client the added value you can bring to the project.

How much do I need to support my current lifestyle?

The expenses listed above are just the costs related to your business, so we can't forget about the daily living costs which include everything else: rent, phone bills, utilities, etc. Write down the salary you'll need to make to keep living the current lifestyle you have.

How do you calculate freelance charges?

You can charge for freelance services in a couple of ways. When starting out, it's common for freelancers to charge hourly rates before transitioning into charging by the project. The reason being is that many freelancers start out by finding work on job boards, where projects are typically listed under hourly rates. Although there's no concrete rule saying that you have to charge hourly. Ultimately, how you charge will be negotiated by you and the client.

- Hourly rate: Charging clients based on the number of hours that you worked on each project.

- Fixed pricing: Charging a flat rate for the entire project, no matter how many hours you spent working on it.

How much should a freelancer charge per hour?

Calculating a freelancer's hourly rate can get pretty complicated. And while it might be tempting to just look up what salaried employees at your experience level are earning and charge that amount, you still need to factor in all of the extra business expenses that come with owning a freelance business.

Calculating your initial hourly rate

You can start by thinking about your desired annual salary. How much do you want to earn this year? Make sure that it's a realistic salary figure based on the amount of experience you have and, most importantly, the level of value you can bring to a client.

Once you have a salary in mind, you'll need to calculate the number of billable hours you plan to work each week to determine your minimum hourly rate.

For instance, let's say you need to make $75,000/year. You can start by dividing the number of weeks in a year by the billable hours you plan to work per week. To make it simple:

$75,000 ÷ 52 ÷ 40 hr./week = $36.05/hr.

However, it's important to note, that this hourly rate doesn't account for the additional "overhead expenses" we've been talking about.

This means that a freelance rate needs to be a bit higher than an employee rate. You can calculate your freelance hourly rate by taking your desired annual income amount and multiplying it by 1.2 to offset the various taxes. Let's take a closer look at this formula.

Calculating the freelance hourly rate

Let's stick with that same $75,000 salary. The formula now breaks down to:

$75,000 ÷ 52 ÷ 40 hr./week x 1.2 = $43.27/hr.

Now, you have an adjusted freelance rate of $90,000 to keep you in the safe zone.

This figure can be used by freelancers of all levels of experience, whether you're just starting out or have been in the game for years.

However, experienced freelancers often use what's called "value-based pricing."

The value-based pricing strategy

Many professional freelancers charge based on the amount of value that their projects give to a company. The idea is that the more value you provide, the more you can charge. Have you had a few successful projects in the past? Past project outcomes are a great way to show clients the value you can add to their business.

This strategy is more commonly applied to "fixed pricing" rather than with hourly rates.

It's also not the best way for newer freelancers to land clients in the beginning, since it's likely that you don't have much experience yet to "prove" your value.

Although, why spend time trying to calculate these figures yourself when you can use a simple freelance rate calculator?

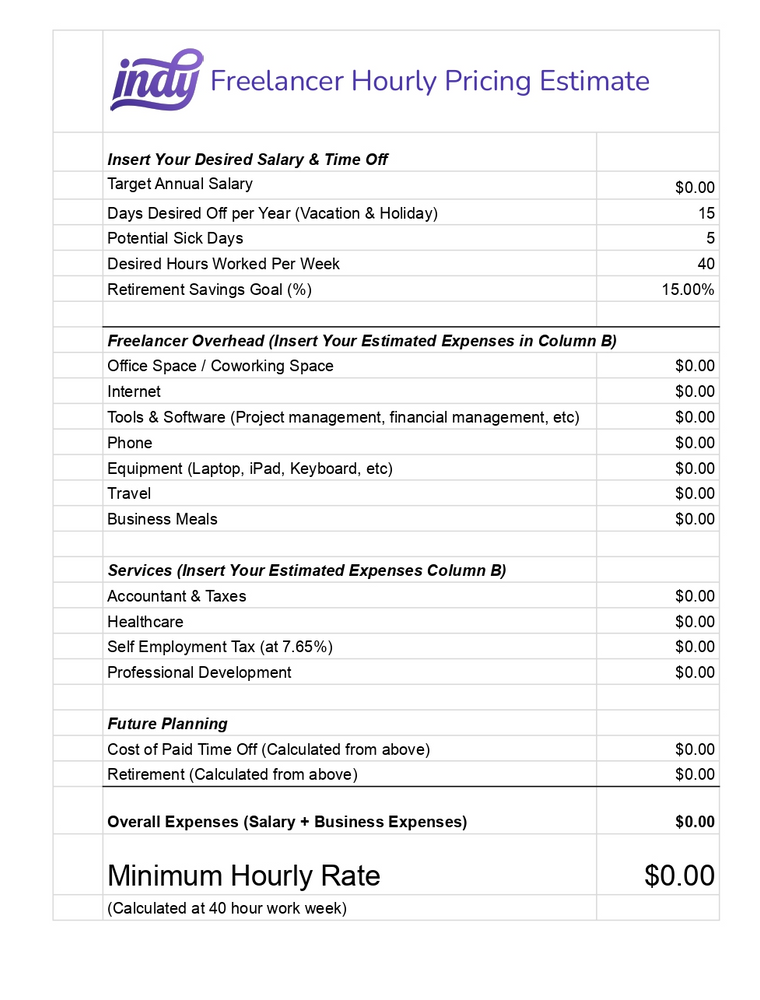

Indy's freelance rate calculator

At Indy, we’ve got your back. We’ve put together this incredibly simple pricing worksheet to help you understand the minimum amount that you should be charging. Insert simple information such as your desired salary, the amount of time off you want, your retirement savings goals, your overhead costs, and the hours you want to work per week, and we’ll do all the calculations for you of what you need to make to meet these goals.

This number can be used not just for setting an hourly rate but helping you use more informed data and information around what your project rate or retainer fees should be.

Tips for getting your desired annual salary

Once you've used the freelance rate calculator, you'll have discovered the hourly rate that you need to charge. But what happens if a client doesn't want to pay you that rate?

Be prepared to negotiate

You might have to do a bit of negotiating with clients to get the rates you want, so be prepared to justify your pricing and stand firm.

Back up your rates by explaining the project scope and the time involved with the project. Don't focus too much on why you need this specific hourly rate. Instead, focus on how you're contributing to their company and the value it adds to their business. Share past results with them. And if they still don't accept your rates, only you can decide whether their business is still worth pursuing.

Here are some situations where accepting a slightly lower rate could still benefit you:

- Their business would look good on your resume

- They provide extra perks

- It's a quick and easy project to complete

- There's room for more opportunities

Get the client to sign a contract

When you're just starting out, you'll typically be working with small businesses. While most clients understand the mutual benefits of signing contracts, not all clients will. Make sure you get them to sign off on the hourly rate you've negotiated on.

A client who refuses to sign a contract is a client you should probably stay away from. There's a pretty good chance that they can later become a "problem client" who demands things like extra work that goes beyond the original scope of the project.

Wrapping up

The challenge that comes with calculating the freelance hourly rate, is that every freelancer's circumstances and needs will be different, so there isn't a "one price fits all" annual salary. Fortunately, tools like our freelance hourly rate calculator can help you discover the right rate for you. And you can even download our Freelancer Hourly Pricing Worksheet here.

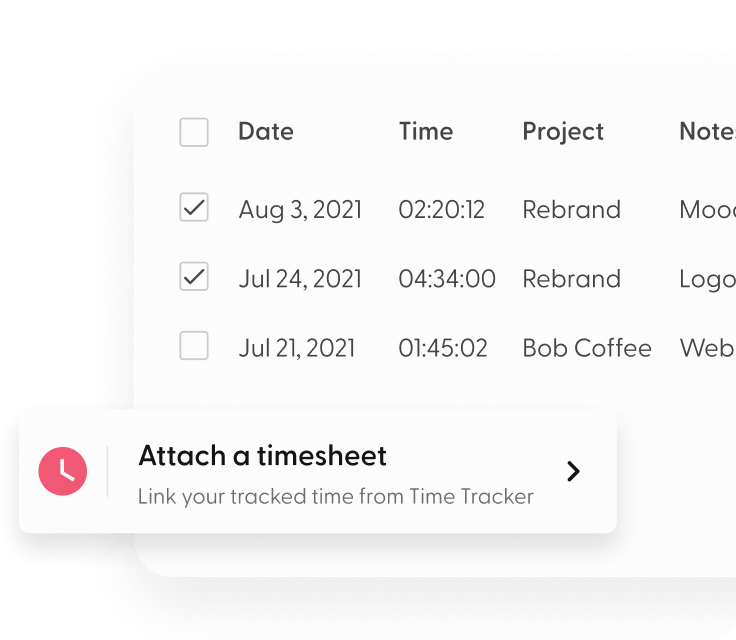

We also have a couple more tools that can help you boost your "billable hours" by cutting down the time it takes to work on the administrative tasks that come with freelancing.

Indy is a project management software designed from the ground up to help freelancers like you take control of your business from beginning to end. You can land new clients with proposal and contract templates, keep track of your billable hours, manage tasks, and get paid fast with invoicing made easy.

Get started today for free!