At least 19 million invoices are issued every year in the USA. These stats are enough proof that invoices are and will continue to be the primary method most businesses use to bill their clients. There are a few dozen invoice types large and small business owners use to bill clients.

Knowing when to use the different invoice types can help you manage your bookkeeping, billing, and cash flow.

What is an invoice?

An invoice is a commercial document issued by a seller to a buyer. It aims to recognize the transaction of business between the two parties. It is not negotiable because it is prepared after the exchange of goods or services.

A typical invoice displays essential information such as the quantity of the shipped goods, price, discounts, shipping details, and other things like the delivery date.

What is a purchase invoice?

A purchase invoice is a document issued by a seller to the buyer as proof that the latter received a service or purchased goods from the buyer. It provides crucial information like the specific goods or services procured, their price, and quantity.

What is a sales invoice?

The sales invoices are the commercial invoices that businesses send to their clients when requesting them to pay for goods sold or services offered. A sales invoice is evidence of the interaction between the seller and buyer, and they describe the good or service, the quantity, and the price.

What are the other types of invoices?

Besides the purchase and sales invoices, many other types of invoices are used for different purposes. These other invoices are:

Standard Invoice

The standard invoice is the most basic type, and many small businesses will use it when billing their clients. It includes everything you can expect to get on an invoice, from the invoice number to other things related to the purchase, like the items purchased and their total cost.

Credit Invoice

A small business can use a credit invoice to refund a client or provide a discount. It often displays a negative figure that covers the amount of refund or discount. For example, businesses that unknowingly overcharge a client for an item with an offer or service can provide a credit note to show the refund.

Debit Invoice

When you want to increase the amount of money a client owes you after extra service or goods, you should issue a debit invoice. Also, debit invoices are used in instances where you undercharge a customer for a service or product.

Mixed Invoice

The mixed invoices are the types that combine both debit and credit entries, meaning you can have both positive and negative amounts in the same invoice. For example, you might have an entry reducing the amount of money a client owes your small business for some products and increasing what they owe for another.

Commercial Invoice

A commercial invoice is not the invoice type a small business owner will issue now and then. These are the types that you generate for goods sold or services offered to international clients. They include information required for clearing the goods with customs, such as the description of the goods, weight or volume, total value, and packaging information.

Timesheet Invoice

The timesheet invoice is what you use when you are being paid for hours worked. They are popular with contract workers that have to record the number of hours worked and certain professionals like lawyers and business consultants.

Expense Report

Expense reports are a type of invoice that employees will prepare for their employer to get reimbursed business-related expenses covered for using their cash. For example, if an employee meets a client for business-related discussions and spends some money on things like lunch, an expense report can be prepared for reimbursement.

Pro Forma Invoice

A pro forma invoice is sent to buyers before shipment as a preliminary bill of sale. It describes the purchased goods and provides other essential details like the shipping weight and charges. A pro forma invoice can also be sent as a quotation for the client with more information on the goods they intend to purchase.

Interim Invoice

If you are handling large projects that entail multiple payments, the interim invoice is what you send when you achieve a particular milestone, and hence you require a portion of the fee. Interim invoices allow businesses to have some cash flow for operation as they work on the project.

Final Invoice

Unlike the interim invoices, the final invoices are sent after the completion of the entire project. It is often more detailed than the preliminary invoices and includes a complete list of everything you did, the total projects cost, and other basics like the invoice number and due date.

Past Due Invoice

A past due invoice is one that the client has not paid per the agreed date and terms, but it should not be confused with a debit invoice. Past due invoices are bad for businesses as they tend to affect cash flow a lot, and the seller spends more time and resources to ensure the clients honor them.

Recurring Invoice

When you have recurring payments from clients, such as payments for subscriptions, you have to prepare a recurring invoice to collect the cash. It is always easier to automate recurring invoices using invoice software as it saves you a lot of time and ensures you do not forget to send them on time.

Pending invoice

Unpaid balances from the last payment are presented in a pending invoice. For example, if you send a client a sales invoice of $500 and a partial payment of $400 is made, you can follow up by sending a pending invoice of $100.

Collective invoices

If you have a regular client that often gives you work in small bits, you can sometimes end up doing a lot of these small projects before invoicing. It is better to prepare a collective invoice that consolidates everything you have done so far in such cases.

Digital invoice

A digital invoice refers to an invoice generated and sent through electronic media such as a computer. It is almost becoming the standard way of sending invoices for most small businesses in this digital age.

Self-billing invoice

As the name suggests, a self-billing invoice is a type that is prepared by the buyer and then sent to the seller or supplier. With this invoice type, the buyer never has to wait for the seller to send the invoice before paying, which can be highly convenient.

Time billing invoice

A time billing invoice allows a business to get value for money by paying only for hours worked. These invoices can be ideal for service providers and creatives handling projects where they are not sure how much time they will take to complete.

Utility invoice

Utility invoices are recurring invoices that are issued and paid monthly or biweekly. They are typically invoices or bills for utilities like electricity, gas, water, and waste. Businesses that produce utility invoices have several accounts, and so the invoices all look the same and are typically generated automatically.

Milestone based invoice

A milestone-based invoice is prepared by a service provider or contractor to request payment once a particular milestone is achieved. For example, a road construction contractor building 100 miles of road can send a milestone-based invoice for every 10 miles completed.

Account Statement

Although an account statement is technically not an invoice, it is something every business deals with often. It is more like a bank statement as it provides a summary of what the company bought and other things like payments made and outstanding balances due.

The miscellaneous invoice

Miscellaneous invoices allow you to bill your clients for payments of non-job-related expenses or services. For instance, you can send a miscellaneous invoice for clients to pay for consultation fees and service charges.

Evaluated Receipt Settlement (ERS)

Evaluated receipt settlement (ERS) is where a buyer agrees with the seller that no invoice will be generated for a particular purchase. Instead, the invoices are posted automatically using data from the purchase order. ERS aims to prevent invoice variance by allowing for automatic goods receipt settlement.

Tax invoice

Tax invoices are issued by dealers and wholesalers to their customers, and they show the amount of tax payable based on the goods purchased or services offered. Besides showing the tax charged, these invoices also include product description, value, and quantity.

The Essential Elements Every Invoice Should Include

Once you know the different invoice types, what to send your clients, and when the next important step is knowing how to prepare one correctly. But, any invoice you make should be good enough provided it includes the following essential elements.

Please note that in most countries an invoice sent without the correct information can be returned as invalid. Government regulations may also require specific information, such as a sequential invoice numbering system.

Invoice number

All invoices need to have an invoice number to make it easy to track and for your record keeping. These numbers have to be unique for every invoice you make, and it is always better to follow a specific sequence when assigning them.

Business contact information

Given that most invoices will require some action from the client, it is vital to include your business contact information to make it easier for them to contact you. Make sure your invoice has your business address, email, and telephone number. Also, ensure you include the client's contact information.

Descriptions of goods or services rendered

Although the client already knows what goods or services you offered them, it is still vital to include all the information about the transaction. Having everything written down prevents conflicts and misunderstandings.

Payment terms

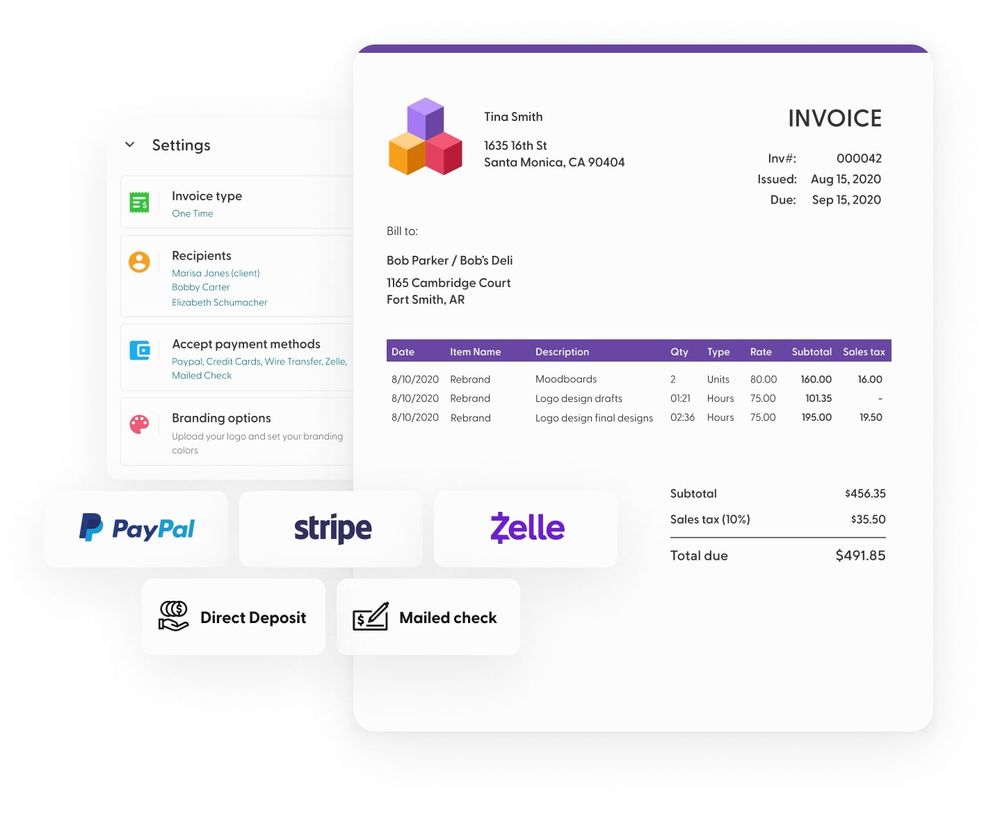

The payments terms should always be clearly stated on the invoice. Ensure the client knows whether you need to be paid in one installment or a few of them and the due date. Additionally, it also helps to include the modes of payment you accept.

FAQs

When should invoices be issued?

Invoices should be issued once the seller completes the order or provides the service. However, this depends on the specific invoice type being given.

How long should you give someone to pay an invoice?

An invoice can be paid on any date the seller and buyer agree. But, if there is no agreement, the "net 30" rule should apply, meaning the customer needs to pay in 30 days once the invoice is received.

Are invoices legal documents?

On its own, an invoice is not a legally binding document. However, once both the seller and buyer agree on its content and there is proof for this, it becomes a legal document.

What happens when a customer refuses to pay an invoice?

The first step should always be to reach out to the customer and resolve the issue amicably. Also, charging small fees for unpaid invoices (for example, 10 to 15%) can be helpful. But, the final option is seeking legal redress.

Are an invoice and a receipt the same thing?

No, an invoice is a payment request, while receipts act as proof of payment.

Can I use the invoice as a receipt?

No, an invoice cannot be used as a receipt. The reverse is also not possible, given the two documents are meant for different purposes.

Is an invoice more like a bill or a receipt?

Invoices are more like bills than receipts. Like bills, they provide a clear description of the goods or services supplied and the amount of money owed to the business.

How are invoices different from receipts?

Receipts prove that the customers have paid for the purchased goods, while invoices are meant to request them to pay the money owed for services or products.

Are digital and electronic invoices the same thing?

All electronic invoices are digital invoices, but all digital invoices are not electronically produced. A digital invoice is any that is not on paper but is readable to people. In contrast, an electronic invoice is a digital invoice that is processed electronically using an automated accounting system.

What is the difference between a voucher and an invoice?

Invoices are detailed bills sent to a buyer by the vendor requesting payment for goods or services. A voucher is a document produced by the payables department in a company to gather necessary documentation before paying vendors for services and products.

Are invoice numbers and bill numbers the same?

They are different numbers, given they are used on separate documents. An invoice number is systematically assigned to invoices, while bill numbers are used to organize and track bills.

What is the difference between a purchase order and an invoice?

Purchase orders are generated and sent to sellers by the buyers, and they help track and control the purchase process. Invoices are requests for payment to the buyer from the seller that is sent once the order is fulfilled or services are offered.