Funding Proposal Template

Introduction

Dear Shari Hess,

Thank you for granting me the opportunity to submit my funding proposal to you. As I shared in our recent conversation, I will use this proposal to discuss how the funding amount of $280,000 from Bread and Butter Bookkeeping can help me achieve my business goals.

In my proposal, I will provide a detailed overview of the following:

- Why my business is a great funding choice

- Plans to provide business updates following funding

- Specific funding needs

- Deadlines and deliverables

- Proposed terms of payment

After reviewing this funding proposal, please reach out to me with any questions or concerns. I will be happy to speak with you over the phone to offer clarity or provide more extensive details regarding my proposal.

Best,

Eloise White

Why Eloise White for business services?

My business has experienced profit growth of more than 50% over the past year. With funding from Bread and Butter Bookkeeping, I can accommodate my expanding customer base while improving and expanding my services. I project that making these necessary adjustments will result in an additional 25% increase in profits over the next year.

My clientele is extremely pleased with my business operations in their current state. Funding will help me make further improvements. Please review these testimonials from my clients:

- Eloise White is fantastic to work with. I regularly place orders and have never had to worry about delays in shipping or defective products upon arrival. Over the past year, Eloise White has become my number one source for the best products on the market. –James, President of client’s business

- Eloise White is unparalleled when it comes to professionalism and timely product delivery. Any products that have arrived in less than stellar condition have always been immediately replaced. I always recommend Eloise White to prospective customers. –Rebecca, Director of client’s business.

I am proud to say that my clients value my consistent results, professionalism, and steadfast commitment to deadlines.

Project description

I understand that as a company funding a relatively new business, you will want to feel confident that you are making the right investment. I have included with this funding proposal an updated business plan that outlines my original objectives, important milestones achieved, and changes I have made and plan to make to continuously improve my business model. I have also included my gross profits for my first two years of business and profit projections for the next five years. You will also receive my financial proposal, which details how Bread and Butter Bookkeeping can profit from funding my company’s ventures.

Objectives

I have already received 60% of my total funding needs from several investors. Receiving the additional 40% totaling $280,000 from Bread and Butter Bookkeeping will help me achieve my remaining objectives for the next year. I will break down these objectives.

- Personnel: I plan to hire 1 full-time employee and one part-time employee. Our part-time employee will handle our IT needs, and our full-time employee will be responsible for all office duties. Costs for these employees are expected to total $88,000 in the first year, including payroll tax and insurance coverage costs.

- Inventory: With my company’s orders doubling over the last year, I will need funds to increase inventory, including shipping supplies, machinery parts, and tools for repair. Inventory currently accounts for $75,000 of my annual budget.

- Location: Funding from Bread and Butter Bookkeeping will help my business relocate to a larger facility that can accommodate growing staff, increased inventory, and better performing machinery. Estimated down payment and monthly rental costs for the first year total $100,000.

- Hardware/software upgrades: My business operates using an order fulfillment system that requires the latest computer hardware and software. I expect costs for upkeep of this fulfillment system to reach $5,000 annually.

- Marketing costs: I plan to expand my marketing outreach to include PPC and social media campaigns. I estimate that marketing costs for the year will reach $12,000.

In my regular reports, I will inform you on the evolution of my business and impact of your funding. If you have questions along the way, feel free to call me or send an email to eloisewhite@gmail.com.

Deadline and deliverables

Per our conversation, I am committed to ensuring that funds provided by Bread and Butter Bookkeeping have been properly invested and that I am held accountable for presenting you with regular updates on my company’s growth.

Each month, starting 30 days from receipt of funding from Bread and Butter Bookkeeping, I will begin to provide a summary update of the following:

- Key personnel changes

- Notable and pending business milestones

- Runway and burn rate

- Top line revenue

- Gross profits

- Company direction changes

- Target market adjustments

I will meet my proposed update deadlines to ensure you feel confident that you have invested in a profitable business that promises year-over-year growth for the foreseeable future.

Payment terms

Structuring your payments is important for your cash flow and the client’s clarity. List specific payments and dates in your proposal to avoid any confusion. You should also include details about any extra work or extra charges for your funding services.

Projects such as this one run for several months before they finish. To facilitate these projects, I offer a schedule of payments. Here are the payment milestones:

- 25% initial payment due upon signing the contract and before any work begins.

- A further 25% of the total will be invoiced once the final audit and action plan has been approved.

- The next 25% of the total will be due once the final page has been optimized.

- Payment of the remaining 25% will be due once the final weekly report is made to signal the end of the contract.

Upon receipt of the final issuance of requested funding, I will send confirmation that your portion of our financial contract is complete. In the financial proposal I plan to present to you, I will outline three options to consider for my repayment of the funding issued by Bread and Butter Bookkeeping. Once we agree on the financial terms, I will repay according to those terms and in a timely fashion until repayment is complete.

Agreement

Once you agree to this proposal, I will prepare a simple contract for funding. The contract will reference the terms of this proposal, including any amendments you suggest. If you agree to these terms, please sign below, and return this proposal to me.

Thank you very much. I look forward to working with Shari Hess.

Signed

Shari Hess

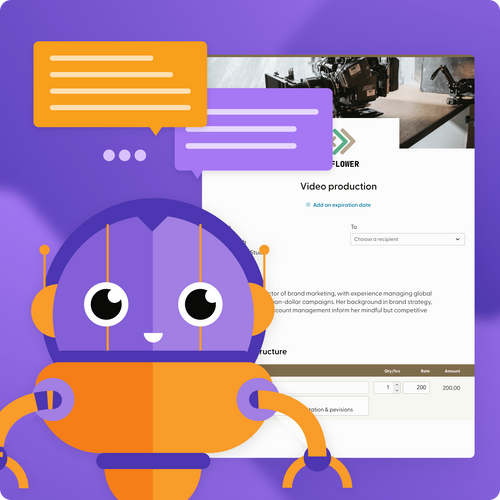

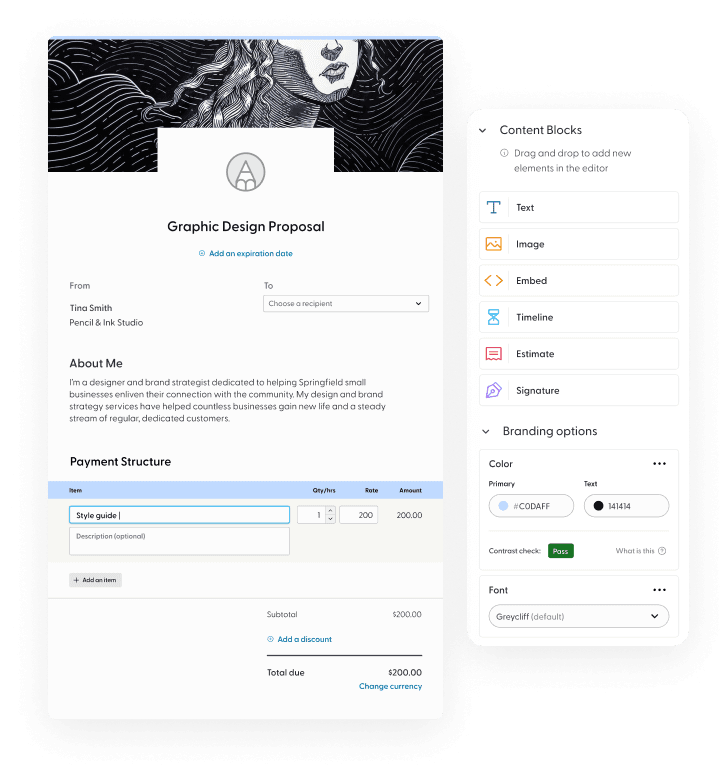

How it works

Why Indy?

- Seal the deal with legally vetted contracts that protect your work, time, and money.

- Manage your tasks and clients with simple yet powerful to-do lists and boards.

- Record your time automatically and track which hours have been paid or need to be billed.

- Get paid fast with invoices and accept multiple payment methods right through Indy.

- Get a bird’s-eye view of everything due with a personal command center that monitors the status of your proposals, contracts, tasks, and invoices.

Funding Proposal Template FAQ

Indy University

Explore our blog for more info on making waves.