Bookkeeping Contract Template

Here is how to use Indy's Contract Creator to get started:

Create, send, and sign contracts faster

- Create a contract using our templates or your own.

- Edit our fully customizable contract templates to make them just right for your project.

- Include a description of your services, rate and payment schedule, delivery milestones, and more.

- Send your contracts straight from Indy or export them to PDF to send them however you want.

- Close deals faster with integrated e-signatures.

- Keep track of each contract’s status, so you know who has signed and who to remind.

- Organize your projects, track your time, manage your to-do’s, get paid, and more.

How to Get Started with a Bookkeeping Contract Today

Create new bookkeeping contracts quickly and easily. Here's an example of an Indy contract:

Bookkeeping Contract

This Bookkeeping Agreement (the "Agreement"), dated [the date both parties will have signed] is entered into by [bookkeeper name], an individual residing in [address], (the "Bookkeeper"), and [client name], an individual residing in [address], (the "Client").

Whereas, the Bookkeeper and the Client desire to establish the terms and conditions under which the Bookkeeper will provide services to the Client, the parties agree as follows:

1. Scope of Work. The Bookkeeper agrees to perform such consulting, advisory and related services specified on Exhibit A to this Agreement ("Description of Services").

2. Term. This Agreement shall commence from the date this Agreement is signed by both parties and shall continue until the scope of work defined in the Description of Services is completed (such period, as it may be extended or sooner terminated in accordance with the provisions of Section 4, being referred to as the ("Service Period").

3. Payment.

a. Service Cost. In consideration of the Service, the Client will pay the Bookkeeper of $ per hour (the "Service Cost").

b. Expenses. The Bookkeeper shall be responsible for all business expenses incurred by the Bookkeeper in connection with, or related to, the performance of the services.

c. Invoices. The Client shall pay to the Bookkeeper amounts shown on each statement or invoice described in Section 3(a) and 3(b) within () days after receipt thereof.

d. Benefits. The Bookkeeper shall not be entitled to any benefits, coverages or privileges, including, without limitation, health insurance, social security, unemployment, medical or pension payments, made available to employees of the Client.

4. Termination. This Agreement may be terminated prior to the end of the Service Period in the following manner: (a) by either the Bookkeeper or the Client upon not less than () days prior written notice to the other party; (b) by the non-breaching party, upon twenty-four (24) hours prior written notice to the breaching party if one party has materially breached this Agreement; or (c) at any time upon the mutual written consent of the parties hereto. In the event of termination, the Bookkeeper shall be entitled to payments for services performed that have not been previously paid and, subject to the limitations in Section 3.2, for expenses paid or incurred prior to the effective date of termination that have not been previously paid. Such payment shall constitute full settlement of any and all claims of the Bookkeeper of every description against the Client. In the event that the Client’s payment to the Bookkeeper exceeds the amount of services performed and (subject to the limitations in Section 3.2) for expenses paid or incurred prior to the effective date of termination, then the Bookkeeper will immediately refund the excess amount to the Client. Such refund shall constitute full settlement of any and all claims of the Client of every description against the Bookkeeper.

5. Cooperation. The Bookkeeper shall use Bookkeeper's best efforts in the performance of Bookkeeper's obligations under this Agreement. The Client shall provide such access to its information and property as may be reasonably required in order to permit the Bookkeeper to perform Bookkeeper's obligations hereunder. The Bookkeeper shall cooperate with the Client’s personnel, shall not interfere with the conduct of the Client’s business and shall observe all rules, regulations and security requirements of the Client concerning the safety of persons and property.

6. Proprietary Information and Inventions.

a. Proprietary Information.

1. The Bookkeeper acknowledges that Bookkeeper’s relationship with the Client is one of high trust and confidence and that in the course of Bookkeeper's service to the Client, Bookkeeper will have access to and contact with Proprietary Information. The Bookkeeper will not disclose any Proprietary Information to any person or entity other than employees of the Client or use the same for any purposes (other than in the performance of the services) without written approval by an officer of the Client, either during or after the Consultation Period, unless and until such Proprietary Information has become public knowledge without fault by the Bookkeeper.

2. For purposes of this Agreement, Proprietary Information shall mean, by way of illustration and not limitation, all information, whether or not in writing, whether or not patentable and whether or not copyrightable, of a private, secret or confidential nature, owned, possessed or used by the Client, concerning the Client’s business, business relationships or financial affairs, including, without limitation, any Invention, formula, vendor information, customer information, apparatus, equipment, trade secret, process, research, report, technical or research data, clinical data, know-how, computer program, software, software documentation, hardware design, technology, product, processes, methods, techniques, formulas, compounds, projects, developments, marketing or business plan, forecast, unpublished financial statement, budget, license, price, cost, customer, supplier or personnel information or employee list that is communicated to, learned of, developed or otherwise acquired by the Bookkeeper in the course of Bookkeeper's service as a Bookkeeper to the Client.

3. The Bookkeeper’s obligations under this Section 6 shall not apply to any information that (i) is or becomes known to the general public under circumstances involving no breach by the Bookkeeper or others of the terms of this Section 6, (ii) is generally disclosed to third parties by the Client without restriction on such third parties, or (iii) is approved for release by written authorization of an officer of the Client.

4. The Bookkeeper agrees that all files, documents, letters, memoranda, reports, records, data sketches, drawings, models, laboratory notebooks, program listings, computer equipment or devices, computer programs or other written, photographic, or other tangible material containing Proprietary Information, whether created by the Bookkeeper or others, which shall come into Bookkeeper's custody or possession, shall be and are the exclusive property of the Client to be used by the Bookkeeper only in the performance of Bookkeeper's duties for the Client and shall not be copied or removed from the Client’s premises except in the pursuit of the business of the Client. All such materials or copies thereof and all tangible property of the Client in the custody or possession of the Bookkeeper shall be delivered to the Client, upon the earlier of (i) a request by the Client or (ii) the termination of this Agreement. After such delivery, the Bookkeeper shall not retain any such materials or copies thereof or any such tangible property.

5. The Bookkeeper agrees that Bookkeeper’s obligation not to disclose or to use information and materials of the types set forth in paragraphs (2) and (4) above, and Bookkeeper's obligation to return materials and tangible property set forth in paragraph (4) above extends to such types of information, materials and tangible property of customers of the Client or suppliers to the Client or other third parties who may have disclosed or entrusted the same to the Client or to the Bookkeeper.

6. The Bookkeeper acknowledges that the Client from time to time may have agreements with other persons or with the United States Government, or agencies thereof, that impose obligations or restrictions on the Client regarding inventions made during the course of work under such agreements or regarding the confidential nature of such work. The Bookkeeper agrees to be bound by all such obligations and restrictions that are known to Bookkeeper and to take all action necessary to discharge the obligations of the Client under such agreements.

b. Inventions.

1. All inventions, ideas, creations, discoveries, computer programs, works of authorship, data, developments, technology, designs, innovations and improvements (whether or not patentable and whether or not copyrightable) which are made, conceived, reduced to practice, created, written, designed or developed by the Bookkeeper, solely or jointly with others or under Bookkeeper's direction and whether during normal business hours or otherwise, (i) during the Consultation Period if related to the business of the Client or (ii) after the Consultation Period if resulting or directly derived from Proprietary Information (as defined below) (collectively under clauses (i) and (ii), "Inventions"), shall be the sole property of the Client. The Bookkeeper hereby assigns to the Client all Inventions and any and all related patents, copyrights, trademarks, trade names, and other industrial and intellectual property rights and applications therefore, in the United States and elsewhere and appoints any officer of the Client as Bookkeeper's duly authorized attorney to execute, file, prosecute and protect the same before any government agency, court or authority. However, this paragraph shall not apply to Inventions which do not relate to the business or research and development conducted or planned to be conducted by the Client at the time such Invention is created, made, conceived or reduced to practice and which are made and conceived by the Bookkeeper not during normal working hours, not on the Client’s premises and not using the Client’s tools, devices, equipment or Proprietary Information. The Bookkeeper further acknowledges that each original work of authorship which is made by the Bookkeeper (solely or jointly with others) within the scope of the Agreement and which is protectable by copyright is a "work made for hire," as that term is defined in the United States Copyright Act.

2. Upon the request of the Client and at the Client’s expense, the Bookkeeper shall execute such further assignments, documents and other instruments as may be necessary or desirable to fully and completely assign all Inventions to the Client and to assist the Client in applying for, obtaining and enforcing patents or copyrights or other rights in the United States and in any foreign country with respect to any Invention. The Bookkeeper also hereby waives all claims to moral rights in any Inventions.

3. The Bookkeeper shall promptly disclose to the Client all Inventions and will maintain adequate and current written records (in the form of notes, sketches, drawings and as may be specified by the Client) to document the conception and/or first actual reduction to practice of any Invention. Such written records shall be available to and remain the sole property of the Client at all times.

4. Notwithstanding the foregoing in this Section 6(b), the ownership and use of the Inventions that are assigned to the Client in Section 6(b)(i) (the "Assigned Inventions") shall be limited as set forth in Exhibit B.

7. Limitation of Liability. Notwithstanding anything to the contrary contained elsewhere herein, neither party shall be liable to the other for any consequential, special, incidental, indirect or punitive damages of any kind or character, including, but not limited to, loss of use, loss of profit, loss of anticipated profit, loss of bargain, loss of revenue or loss of product or production, however arising under this contract or as a result of, relating to or in connection with the service and the parties’ performance of the obligations hereunder, and no such claim shall be made by any party against the other regardless of whether such claim is based or claimed to be based on negligence (including sole, joint, active, passive, or concurrent negligence, but excluding gross negligence), fault, breach of warranty, breach of agreement, breach of contract, statute, strict liability or any other theory of liability.

8. Indemnification. The Bookkeeper shall be solely liable for, and shall indemnify, defend and hold harmless the Company and its successors and assigns from any claims, suits, judgments or causes of action initiated by any third party against the Company where such actions result from or arise out of the services performed by the Bookkeeper or its Employees under this Agreement. The Bookkeeper shall further be solely liable for, and shall indemnify, defend and hold harmless the Company and its successors and assigns from and against any claim or liability of any kind (including penalties, fees or charges) resulting from the Bookkeeper’s or its Employees’ failure to pay the taxes, penalties, and payments referenced in Section 9 of this Agreement. The Bookkeeper shall further indemnify, defend and hold harmless the Company and its successors and assigns from and against any and all loss or damage resulting from any misrepresentation, or any non-fulfillment of any representation, responsibility, covenant or agreement on its part, as well as any and all acts, suits, proceedings, demands, assessments, penalties, judgments of or against the Company relating to or arising out of the activities of the Bookkeeper or its Employees and the Bookkeeper shall pay reasonable attorneys’ fees, costs and expenses incident thereto.

9. Independent ContrBookkeeper Status. The parties shall be deemed independent contrBookkeepers for all purposes hereunder. Accordingly:

a. The Bookkeeper will use its own equipment, tools and materials to perform its obligations hereunder.

b. The Client will not control how the Service is performed on a day-to-day basis and the Bookkeeper will determine when, where and how the Service will be provided.

c. The Client will not provide training to the Bookkeeper.

d. The Bookkeeper will be solely responsible for all state and federal income taxes in connection with this Agreement.

e. This Agreement does not constitute an employment, partnership, joint venture or agency between the parties hereto, nor shall either of the parties hold itself out as such contrary to the terms hereof by advertising or otherwise nor shall either of the parties become bound or become liable because of any representation, action or omission of the other.

10. General.

a. Survival. Sections 4 through 11 shall survive the expiration or termination of this Agreement.

b. Non-Solicitation. During the Service Period and for a period of [six (6) months] thereafter, the Bookkeeper shall not, either alone or in association with others, (a) solicit, or permit any organization directly or indirectly controlled by the Bookkeeper to solicit, any employee of the Client to leave the employment of the Client, or (b) solicit or permit any organization directly or indirectly controlled by the Bookkeeper to solicit any person who is engaged by the Client.

c. Use of Subcontractors. The Bookkeeper may use trusted contractors to complete components of the Bookkeeper’s obligations hereunder, provided that the Bookkeeper shall remain solely responsible for such contractors’ performance, that the Client shall have no obligation to such contractors and the use of such contractors shall not cause any increase in fees, costs or expenses that would otherwise be payable hereunder.

d. Entire Agreement. This Agreement (including the documents referred to herein) constitutes the entire agreement between the Client and the Bookkeeper and supersedes any prior understandings, agreements or representations by the parties, whether written or oral, with respect to the subject matter hereof.

e. Assignment. Neither party may assign or transfer this Agreement in whole or in part, nor any of the rights hereunder, without prior written consent of the other party.

f. Notices. All notices required or permitted under this Agreement shall be in writing and shall be deemed effective upon personal delivery or upon deposit in the United States Post Office, by registered or certified mail, postage prepaid, addressed to the other party at the address shown above, or at such other address or addresses as either party shall designate to the other in accordance with this Section 13.

g. Amendments. No amendment of any provision of this Agreement shall be valid unless the same shall be in writing and signed by each party.

h. Severability. Any term or provision of this Agreement that is invalid or unenforceable in any situation in any jurisdiction shall not affect the validity or enforceability of the remaining terms and provisions hereof or the validity or enforceability of the offending term or provision in any other situation or in any other jurisdiction. If the final judgment of a court of competent jurisdiction declares that any term or provision hereof is invalid or unenforceable, the Bookkeeper and the Client agree that the court making the determination of invalidity or unenforceability shall have the power to limit the term or provision, to delete specific words or phrases, or to replace any invalid or unenforceable term or provision with a term or provision that is valid and enforceable and that comes closest to expressing the intention of the invalid or unenforceable term or provision, and this Agreement shall be enforceable as so modified.

i. Force Majeure. Neither party will be liable for any failure or delay in its performance under this Agreement due to any cause beyond its reasonable control, including acts of war, acts of God, earthquake, flood, fire, embargo, riot, sabotage, or failure of third party power or telecommunications networks, provided that the delayed party: (a) gives the other party prompt notice of such cause and (b) uses its reasonable commercial efforts to promptly correct such failure or delay in performance.

j. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of (other than any principle of conflict or choice of laws that would cause the application of the laws of any other jurisdiction).

k. Arbitration. Any unresolved controversy or claim arising out of or relating to this Agreement, except as (i) otherwise provided in this Agreement, or (ii) any such controversies or claims arising out of either party’s intellectual property rights for which a provisional remedy or equitable relief is sought, shall be submitted to arbitration by one arbitrator mutually agreed upon by the parties, and if no agreement can be reached within thirty (30) days after names of potential arbitrators have been proposed by the American Arbitration Association (the “AAA”), then by one arbitrator having reasonable experience in corporate finance transactions of the type provided for in this Agreement and who is chosen by the AAA. The arbitration shall take place in , , in accordance with the AAA rules then in effect, and judgment upon any award rendered in such arbitration will be binding and may be entered in any court having jurisdiction thereof. The prevailing party shall be entitled to reasonable attorney’s fees, costs, and necessary disbursements in addition to any other relief to which such party may be entitled.

l. Counterpart. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument. This Agreement may be executed by facsimile, digital or electronic signature.

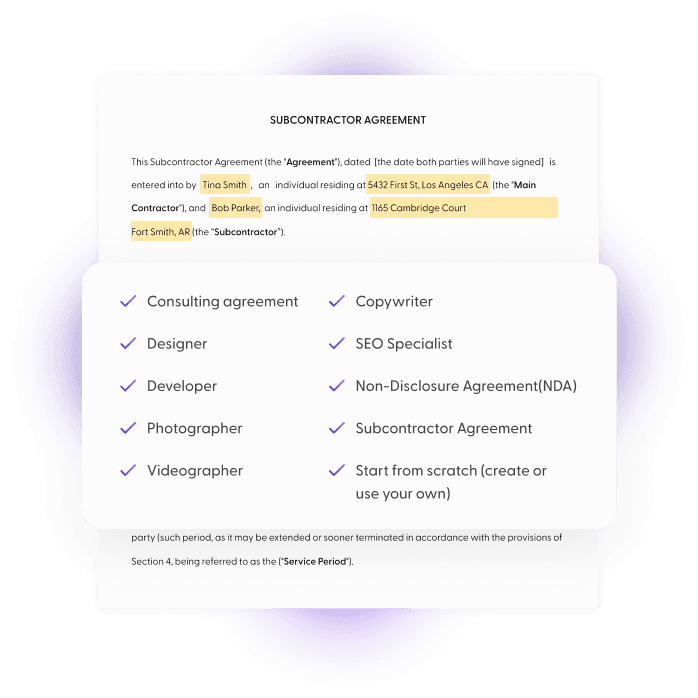

Other Contract Templates

Indy University

Explore our blog for more info on making money.