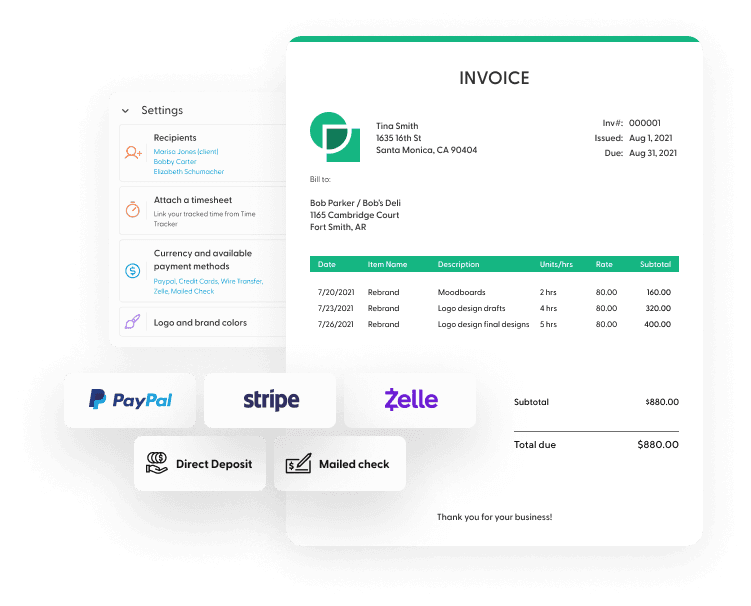

Enhance your invoice template to better reflect your brand by adding a logo, selecting corresponding colors and fonts, and arranging the layout. Personalizing this document not only emphasizes professionalism, but it also makes identification of invoices from you easier for clients. Your customized templates have the advantage of being more recognizable than generic print ones when processed by customers.

Adding Your Logo

In order to help strengthen your brand identity and make the invoice stand out, incorporating a logo into the template is an easy yet effective strategy. To put this in practice, open up the desired format of choice and add an image file with your logo.

A minor tweak like this can result in noticeable changes to both professionalism as well as overall appearance for invoices produced from that particular template.

Selecting Brand Colors and Fonts

For a cohesive visual identity across business materials, it's essential to use the same brand colors and fonts on your invoice template as you do elsewhere. You should be selective with color choices that coordinate well together plus utilize fonts that are easily understandable in order to make an invoicing design that looks expert while still mirroring your company’s character and standards. It is important for the text of this typeface used within the document to maintain readability by using large enough font sizes while breaking up into paragraphs too.

Organizing the Layout

For an effective and easy-to-follow invoice template, it is essential to have a well laid out structure. When designing the layout of your billing form, take into account what type of payment details will be featured and decide how best to display them.

Label each component distinctly as well as arrange them in a logical sequence so that customers can quickly scan through the content easily and make payments on time.

Utilizing Online Invoicing Tools for Self-Employed Professionals

For self-employed professionals, having access to online invoicing tools can be incredibly advantageous as they allow for time savings and automated reminders. These useful instruments also provide business insight into their performance through analytic reports that are accessible with the click of a button, allowing them to improve cash flow while maximizing their productivity.

Time-Saving Features

Using online invoicing tools can make managing your finances easier and faster. Automated billing, payment reminders, storage of client info, these are only some of the features that enable you to focus on business growth rather than administering payments. Encrypted billing plus customizable invoice designs along with integrated tracking of all transactions become a reality when using such services.

The convenience and time-saving benefits associated with online payments and with taking advantage of digital invoices have an undeniable role in improving daily operations for businesses looking to stay competitive while keeping their customers satisfied through efficient processing times.

Automated Reminders

Online invoicing tools can provide an incredibly helpful automated reminder feature which allows you to easily save time and maintain a professional appearance. Clients are sent notifications when payments become due, either manually or automatically set by yourself – so that unwanted conversations regarding money do not arise while also keeping your finances in order. In summary, automating reminders is a useful way of increasing efficiency whilst still projecting professionalism from the business side.

Reporting and Analytics

Having access to reporting and analytics features can help business owners gain valuable insights into their performance, empowering them to make sound financial decisions. With online invoicing tools providing the capability for monitoring of payments as well as sales, expenses, customer behaviour and profitability analysis reports, such solutions will provide the capability for monitoring of payments. Enhance invoice management practices in your company.

Legal Requirements and Tax Considerations for Self-Employed Invoices

Being a self employed business necessitates taking into account the lawful needs and taxation aspects of your invoices. This includes Value Added Tax (VAT), sales tax, documentation, and any applicable legal disclaimers.

By making sure that your bills are in line with all pertinent legislations and regulations, you can ward off prospective problems while still upholding a professional demeanour.

Sales Tax and VAT

For self-employed individuals, invoicing must take into account sales tax and VAT regulations. Depending on the area where you do business and what type of services or products are being provided, these taxes may be different. To avoid any possible penalties for noncompliance, it is essential to research laws relevant to taxation so that each invoice can include correct amounts due in taxes. Doing this will help ensure your billing process follows all required rules and regulations while avoiding costly errors down the road.

Record Keeping

For self-employed individuals, accurate documentation of their finances is essential. They must keep track of sales slips, paid bills, receipts and deposit slips for a minimum period of 3 years after filing taxes. This includes canceled checks as well. Storing records in an organized manner helps to guarantee that tax regulations are followed along with providing foundation when making financial decisions.

Legal Disclaimers

Including a legal disclaimer in your invoices as an independent business can be beneficial to protect against potential liabilities. This notice should state that the invoice is merely for asking for payment and all the facts stated within it are correct according to my knowledge. An example of such clause could read like this: "This request for money has accurate information based on what I know." To secure your company, these disclaimers can provide great added security when sending out bills or any other paperwork related to self-employed activities.